In the landscape of retirement planning, ensuring financial security requires a nuanced understanding of qualified retirement income options. With decades of experience in this field, I’ve witnessed firsthand the impact of taxes on retirement income and the importance of optimizing available resources. In this blog post, I delve deeper into the complexities of retirement planning and offer insights into maximizing retirement income through strategic planning.

Understanding the Landscape: IRAs as the Foundation

Individual Retirement Accounts (IRAs) serve as the foundation of many retirement portfolios, offering a centralized platform for retirement savings. Consolidating various retirement accounts into an IRA streamlines management and simplifies Required Minimum Distribution (RMD) calculations. However, the intricate tax implications associated with IRAs necessitate careful consideration.

As we navigate the evolving tax landscape, factors such as the sunsetting of existing tax laws and potential future tax increases underscore the need for a proactive approach to retirement planning. The “widow penalty,” wherein surviving spouses may face less favorable tax brackets, highlights the importance of anticipating and mitigating tax liabilities.

Moreover, the impact of IRAs on heirs must be factored into retirement planning. The requirement to liquidate inherited IRAs within a designated timeframe, coupled with potential tax bracket shifts, can significantly impact the total inherited amount, emphasizing the need for strategic estate planning.

Roth IRAs: Embracing Tax Efficiency

In contrast to traditional IRAs, Roth IRAs offer tax-free distributions and do not mandate RMDs during the account holder’s lifetime. This tax-efficient structure provides retirees with greater flexibility in managing their cash flow, as taxes need not be considered when accessing funds. Additionally, Roth IRAs offer distinct advantages for heirs, as distributions are tax-free, providing a valuable wealth transfer tool.

Given the potential for future tax increases, Roth IRAs present an attractive option for retirement savings. By prioritizing tax-free growth and distributions, retirees can optimize their after-tax income and enhance their financial security in retirement.

Fixed Index Annuities (FIAs): Stability in an Uncertain Market

For individuals seeking guaranteed income in retirement, Fixed Index Annuities (FIAs) offer a reliable solution. By providing a predictable income stream shielded from market volatility, FIAs offer peace of mind and financial security. When combined with Roth accounts, FIAs offer tax-free guaranteed income, protecting against longevity risk and providing additional benefits such as long-term care coverage and inflation adjustments.

Indexed Universal Life (IUL) Insurance: A Strategic Wealth Transfer Tool

Indexed Universal Life (IUL) insurance has emerged as a strategic wealth transfer tool, particularly considering the tax implications associated with IRAs. Offering tax-free loans against the policy, IUL provides a means to pass on wealth efficiently while ensuring financial security for heirs. By leveraging the tax advantages of IUL, retirees can optimize their estate planning and maximize the benefits passed on to future generations.

Optimizing Retirement Income: A Holistic Approach

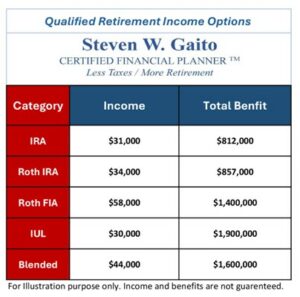

Maximizing retirement income requires a holistic approach that considers the interplay between various retirement income options. By strategically allocating assets across IRAs, Roth IRAs, FIAs, and IUL insurance, retirees can create a customized plan that optimizes after-tax income and total benefits. This strategic approach not only enhances financial security in retirement but also ensures a legacy of wealth and prosperity for future generations.

In conclusion, navigating qualified retirement income options requires careful consideration and strategic planning. By understanding the nuances of each option and leveraging their unique benefits, individuals can create a comprehensive retirement plan that maximizes income and enhances financial security. For a personalized analysis of your retirement options and to chart a path toward financial security, contact my assistant, Morgan Wylie, to schedule a consultation. Morgan.wylie@retirerm.com or (828) 559-0299.